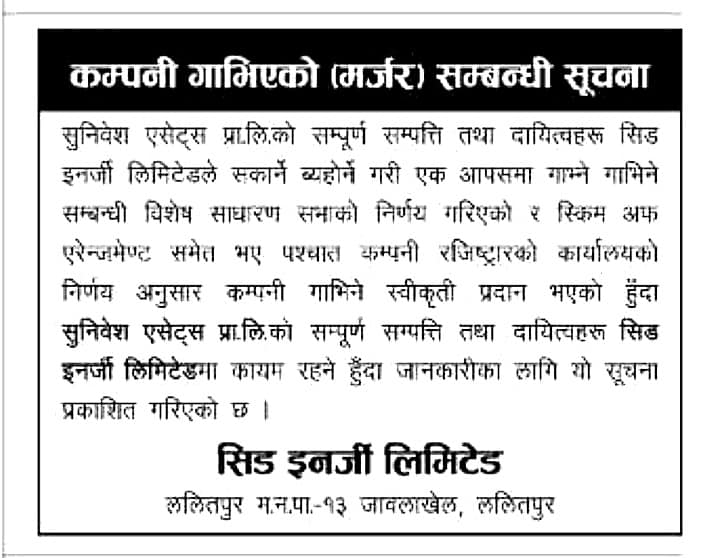

In a significant move toward expanding its investment portfolio and solidifying its position in the market, Seed Energy Ltd proudly announces the successful merger with Sunivesh Assets Pvt. Ltd. This merger, unanimously approved through the Special General Meeting , marks a pivotal step in realizing their shared vision for long-term growth and value creation.

The decision to merge was underpinned by several strategic considerations:

- Strengthened Capital Base: Seed Energy Ltd recognized that its ongoing investments in various sectors, such as energy, hospitality, and real estate, required time for cash flows to materialize fully. The merger with Sunivesh Assets, boasting stable and more immediate cash flows, will provide the necessary financial stability to support these investments.

- Asset Expansion: The merger brings tangible assets owned by Sunivesh Assets into Seed Energy Ltd’s portfolio, offering the potential for enhanced cash flows and greater banking possibilities. This consolidation represents a unique opportunity to leverage shared resources and investor commitments to deliver significant value to all shareholders.

- Enhanced Financial Position: The combined entity will have access to Sunivesh Assets’ current cash flow and asset-based valuation. This positions the newly merged company for sustainable, long-term growth through strategic investments in a variety of sectors.

The merger comes in alignment with Seed Energy Ltd’s broader strategy, which includes raising NPR 1 billion in capital through a rights issue and subsequent plans for an Initial Public Offering (IPO) on the Nepal Stock Exchange (NEPSE).

The leadership of Seed Energy Ltd extends its gratitude to shareholders for their unwavering support and trust. This merger represents a significant milestone in the company’s journey toward becoming a publicly listed entity. The combined strength of Seed Energy Ltd and Sunivesh Assets Pvt. Ltd sets the stage for a promising future of sustainable growth and value creation in the ever-evolving investment landscape.