This section contains Frequently Asked Questions/Queries that will help you know more about SEED Investments; its services, portfolio investments, investors’ propositions, and activities.

Our goal is to provide personal answers to any questions you ask us about SEED Investments. Most questions are usually answered across our FAQ sections.

Please feel free to send in your questions if you need any further clarifications.

1. Who should invest through Seed Investments?

- Anyone with a minimum of NPR. 1 million of surplus income or idle cash.

- Anyone looking for longer-term growth of their investment portfolio.

2. Why should I invest through Seed Investments?

Nepal’s economy has changed radically in recent years but most seem to continue to invest as if it hasn’t. Seed Investments offers a means for investors to gain exposure to those areas of Nepal’s economy that are sometimes not accessible to them in terms of their individual investment size. We work towards consolidating investors to take on investment opportunities.

Seed Investments works towards providing better returns compared to prevailing bank rates. Investment with better but most importantly secure returns over longer periods of time.

Seed Investments also provides better avenues and options for investors to exit with ease.

3. Where does Seed Investments invest?

Investors can gain access to a variety of investment opportunities with Seed Investments. We provide unique blend of equity investment opportunities in diversified sectors including infrastructure, SMEs and new venture opportunities.

We only invest in sound companies with sound management teams or work towards building a base that ensures potential for better growth and expansion.

We invest in businesses that are scalable and that provide goods, services and solutions that address their customers’ needs.

We work with companies that are registered with the Office of Company Registrar only. However, we only work with companies registered in Nepal and at this point we do not work with companies incorporated in other countries.

4. How does Seed Investments invest?

a. SEED INVESTS IN BUSINESSES THROUGH ITS INVESTMENT COMPANIES – owned and managed by its management team and principals. Investors can get access to shares of these investment companies by investing their equity in these investment firms, controlled and managed by Seed Investments.

b. All investment options are reviewed through third party agencies, proper due diligence process are ensured prior to putting in the equity investments. Seed Investments consolidates equity from individual investors to form an investment company, along with its own equity. We ensure disciplined asset allocation and risk management.

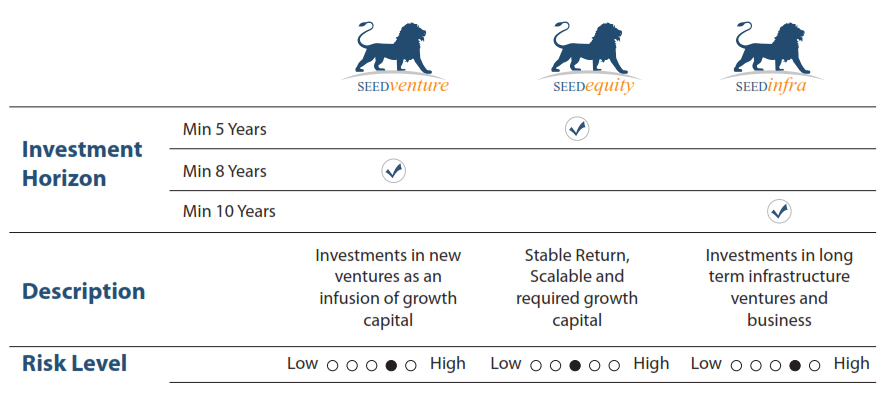

c. Seed Investments invests through primarily three types of structured portfolio –

i. Infrastructure: investments in long term infrastructure ventures and businesses

ii. Equity: Buyouts and/or infusion of/into stable existing SME businesses

iii. Ventures: Investments in new ventures as seed equity.

5. Why does Seed Investments currently maintain three types of investment structure?

a. To consolidate diverse nature of investment options into certain structure based on investment requirements and risks

b. Provide options for investors through diversified portfolio and risk management.

c. Different investment structures have different time horizons.

6. What are the investment structures of Seed Investments?

Investment structures

a. Short Term Investment Period (Growth and Income): for the minimum period of 5 years

This service is offered to investors especially to meet the short term investment needs of clients with the objective of beating the short term bank interest rate. Such investments would be channelled through a particular investment firm and will focus on businesses and opportunities providing steady incomes.

b. Long term Investment Period: for the period more than five years, especially for the time period of 8 years to 10 years.

This service is offered to investors to meet their long term investment need of the client with the objective to get a larger return on investments. Such investments would be channelled through a particular investment firm and will focus on businesses and opportunities that requires longer term grooming and market establishment.

7. How would investors know where to invest?

Each investment structure has its own investment focus, investment time horizon and risk levels. The investors would be provided with the shareholder certificates of respective investment firms bonded through a shareholders’ agreement in terms of their rights and exit policy.

8. How do I get access to Seed Investments’ services? How do I invest through Seed Investments?

a. Seed Investments invests in businesses through it investment companies, owned and managed by its management team and principals. Investors can get access to shares of these investment companies by investing their equity in these investment firms, controlled and managed by Seed Investments.

b. INVESTORS DO NOT INVEST IN SEED, they invest in shares of investment companies managed by Seed Investments.

c. Seed Investments doesn’t only manage investments; it also invests itself, along with your equity, in the business through its investment companies. WE SHARE THE RISKS!

d. We offer equity shares with differential rights to you for the funds invested in the investment company of your choice. Shareholders’ agreement defines the rights of the shareholders.

9. What are my costs of investing through Seed Investments? What are feed and costs?

a. THERE ARE NO DIRECT COSTS TO THE INVESTORS when they invest in the investment companies. One buys differential rights shares of these investment companies at the current valued prices.

b. Capital gain tax and/or dividend related taxes will be applicable on any returns and dividends as in any equity investments.

c. Each of the investment companies, however, has investment management agreement with Seed Investments for a fee. Seed Investments charges investment companies following fees:

i. Annual management Fee (payable annually): 1 – 2 % of the investment fund under management

ii. Carried interests or performance bonus (at exit): 20% of return in excess of the defined hurdle rate (currently at 10%).

10. What are my risks investing with seed?

All investments contain some element of risk. The risks are same as making any equity investments, but risks are reduced as Seed Investments invests in a portfolio of different businesses.

WE SHARE THE BUSINESS RISKS with you by investing our own equity.

11. What are my investor legal rights?

a. We issue DIFFERENTIAL RIGHTS SHARES. But that doesn’t mean one gives away all rights.

b. All shares holders just give away rights of managing and governing the investment companies to the Seed Investments. This is done to ensure stable and continued representation at the businesses where investments have been made.

c. Shareholders of Investment companies have RIGHT TO ALL DIVIDEND AND RETURNS FROM THE INVESTMENTS.

d. Shareholders have RIGHT TO SELL THEIR SHARES to anyone, after practicing first right of refusal offer to the remaining shareholders. Seed Investments can help to negotiate and make a deal.

e. Shareholders have RIGHT TO EXIT at any time after following due procedures and any applicable fees.

12. Is there a minimum investment required?

a. Yes, currently it is NPR. 1 million.

b. Seed Investments also will be coming up with separate small investor investment options for equity investments of NPR 0.5-1 million.

13. Do you offer advice?

Yes. But we offer advice only in the context of the Seed Investments portfolio and investment companies.

14. Are my investments liquid?

Some equity investments may take longer to sell than others, but we ensure facilitation and try to complete the deal for you.

15. How do I know where my money is? What is the current status of my investment?

Your share certificates are proof of your investments and your holdings in each of investment companies managed by Seed Investments.

All investment companies and invested businesses undergo third party audits and compliance checks. We publish half-yearly reports and periodic updates of investments.

16. What if I need to exit of need my investment money back in less than the mentioned time horizon?

a. 1% administrative fee on exit if the investor finds its own buyer.

b. 1% administrative fee and 2% finder’s fee on exit if Seed Investments finds the buyer.

c. No fees after the completion of the mandatory years.